The International Sustainability Standards Board (ISSB) released two Sustainability disclosure standards on June 26, 20231. IFRS S1 is “General Requirements for Disclosure of Sustainability-related Financial Information.”

There’s nothing like reading primary documents. Who has the time? Even if you read the words – but what do they mean for your company? This post – one of a series – is intended to help preparers understand the standards, what’s required, and how to prepare to comply2. “Preparers” includes anyone at an executive level or senior management. It includes anyone in functions (Environmental, HR, IT, Operations, Procurement, etc.) that are responsible for programs, and/or who provide information for disclosures. (Read More)

The Uyghur Forced Labor Prevention Act (UFLPA) has been described as “the most interesting law in the world.” “Interesting” covers a lot of ground. The provisions of UFLPA are poised to disrupt trade, supply chains, product assembly and sales. It may affect operations, compliance, financial and non-financial reporting, and strategies for companies in many sectors. If your company makes or imports apparel or linens that include cotton, this applies to you. If your company makes anything that includes silica (think chips), it applies to you. This white paper highlights key provisions and offers takeaways from UFLPA, as well as context and tips.

PREMISES

INTRODUCTION

The author suggests there are three core attributes of sustainability reporting that differ from financial reporting and disclosures.

Accountants, internal auditors, and assurance providers and others with experience in financial reporting and disclosures are becoming more involved in ESG reporting[1] and disclosures. There are already professionals who have involved in sustainability programs, reporting and reviews as they have evolved. Understanding these can help bridge the gap. It can also improve the effectiveness and efficiency of organization’s governance, strategy, risk management – as well as financial performance and positive impact in non-financial areas.

The Institute of Internal Auditors (IIA) offered an ESG Symposium in April 2021. This virtual event – the first of its kind – was favorably received by over 300 IIA members.

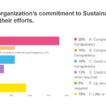

Polling questions provided the opportunity for “instant benchmarking” about ESG drivers and risk, environmental risks, and Internal Audit’s leverage of second line audit activities. This paper provides responses to six questions of keen interest to Internal Audit today, and perspectives on what these responses mean for ESG and Internal Audit.

I presented on ESG and Non-Financial Reporting (aka Sustainability Reporting and Disclosures) in two sessions at the IIA Los Angeles conference in March 2021. Internal Auditors’ response to polling questions provides a glimpse of the state of ESG risk, Internal Audit’s current role, and the journey that lies ahead. This white paper includes the questions, responses, as well as commentary and tips.

Virtual conferences are challenging for fatigued attendees, and presenters too! Presenters can’t interact with attendees, watch body language, expand upon topics of particular interest, or move on at signs of boredom. Presenters can’t ask for a show of hands, but polling questions help.(Read More)

By Douglas Hileman, CRMA, CPEA, P.E

Interested to learn how California companies scored on on slavery & human trafficking? Doug’s contributions on stakeholder forum were given special acknowledgement. The objectives of this white paper are to demonstrate: Why Non-Financial Reporting (NFR) warrants attention from Internal Audit (IA); and How IA can provide value to organizations by addressing NFR. To do so, the paper presents highlights of selected NFR drivers and frameworks, perspectives on risk assessment, and provides suggestions on initial focus areas.

BROCHURE: Non-financial reporting (NFR) has far-reaching impact – for compliance, customer relations and business reputation. DHC’s innovative model contrasts how companies are managing NFR, and current expectations. This mis-match poses risk, and leaves opportunities on the table. Download this brochure, which includes a quick 5-question diagnostic - an initial step to find out how your organization is doing. (Download)

Auditors love to audit, and, given the opportunity, rarely decline to do so. It's important to note that audits are not alwasy the answer; auditor can provide significant value with their audit skills that provide greater value and reduce risk without doing an audit. Featured at www.iia.org.